Technology and Blockchain Journalism

How Andrew Vilenchik is Building a Better Blockchain Community

Andrew Vilenchik, the former CEO of Coinsbank who helped grow the Coinsbank market share and started their popular Blockchain Cruise series, has launched a new venture with the aim of making an even bigger impact on society. As the new CEO of Amerenec (American Renewable Energy Corporation)—“a cutting edge renewable energy innovator”—Vilenchik is now focusing his efforts on developing affordable, clean energy that’s not dependant on government subsidies. Vilenchik and his team will unveil the full scope of the company’s capabilities this April at the Blockchain Nation Conference in Miami. Andrew shared some of the reasons he’s most excited to be involved with Amerenec and some of the other ways he’s continuing his mission to “build a better blockchain community.”“Amerenec will provide safe, renewable energy worldwide at a fraction of the cost. Not only will this clean energy make blockchain mining cheaper and more reliable, but Amerenec will also utilize blockchain technology to keep track of license distribution, logs of sales, and services. And that will make it the first truly transparent public company,” explained Vilenchik. “After Amerenec’s planned IPO, every investor will be able to go online and see what’s happening with every single dollar, as well every component of the company from mechanical function to inventory to accounting.”

The Answers Blowing in the Wind

While the company plans to eventually expand to multiple sources of clean, renewable energy, their current focus is developing the safest, most efficient and cost-effective, wind energy. According to Vilenchik, Amerenec has perfected the use of the vertical axis wind turbine (VAWT), a technology developed by the French aeronautical engineer George Jean Marie Darrieus. Amerenec has packaged the Darrieus turbine for market use and plans to start the process of taking the company public within the next six months.VAWTs are a type of wind turbine where the main rotor shaft is set transverse to the wind (but not necessarily vertically) while the main components are located at the base of the turbine. The Darrieus wind turbine consists of a number of curved aerofoil blades mounted on a vertical rotating framework. The cost of production of these wind turbines is reportedly far lower than that of other available wind turbines. “Our systems are closer to the ground with a simplified motorized head that enables the most cost-effective production and operation,” said Vilenchik. “Our engineers have found the best configuration of height, size, and position to maximize the revenue potential of the wind. If I gave you the numbers, you wouldn’t believe them. I think people will be very impressed, when we announce these figures at the Blockchain Nation Conference in April.”

Protecting the Grid

Another significant problem that Amerenec has addressed is to provide a source of electromagnetic pulse (EMP) safe energy. “With an EMP attack, the whole society could go to the stone age in an instant. It’s a relatively simply problem to solve, but because of the high cost of electricity, it’s not feasible for energy companies to create the shields needed to provide EMP protection,” explained Vilenchik. According to a report by the Commission to Assess the Threat of EMP Attacks, super EMPs are nuclear warheads designed to explode in the atmosphere, generating high-frequency electromagnetic pulses that destroy electronic devices. Testifying before a Congressional Homeland Security subcommittee in October 2017, Peter Vincent Pry, a nuclear strategist formerly with the CIA, warned that millions of lives could be lost through mass starvation, disease and societal collapse if there was ever an EMP attack by North Korea. This report recommended that the government “protect elements of the national electric grids, the keystone critical infrastructure upon which all other critical infrastructures depend.” And according to Vilenchik, Amerenec has found a cost-effective way to shield their wind turbines from EMP damage in the case of such an attack.Roadmap for SuccessWith Amerenec there is no coin involved, but each wind turbine will have a license that can be bought and sold. In the future, buying the licenses will be a way to invest in the company and raise money for its development. The company plans to sell its energy to power companies to help them provide the amount of clean energy required by local legislation without government subsidies. They also plan to help solve a big challenge for cryptocurrency miners since mining has increased the demand for electricity. Because of the rising cost of electricity, a lot of miners are not able to buy all of the electricity they need from power companies. “With our technology, we will provide electricity to the grid, and also offer electricity directly to miners at a substantially lower price. This will mean greater profit margin for the miners.”Amerenec currently has several functioning wind turbines in Europe. They are in the process of confirming their calculations for the US, Caribbean, and Latin American markets. “Within 3 or 4 months, we expect to go into multiple markets. When we scale up, it’s going to be a very large operation,” explained Vilenchik. The company’s development plan also includes investment in the future of clean energy technologies with scholarships and research grants. “We are investing in the brains and R&D of up and coming clean energy scientists who don’t have opportunities to get financed otherwise,” said Vilenchik proudly.As far as competitive pressures go, Vilenchik acknowledges that the supply of materials such as steel will be the main hurdle for scaling the new company. Otherwise he feels very confident about the business model and its chances for success. According to Vilenchik, the Amerenec team includes blockchain industry leaders and high-ranking government officers, the names of which will be announced at the Blockchain Nation Conference in April. Vilenchik would only reveal that Jose Gomez, the former Chief of Staff to the Venezuelan government, is Amerenec’s Director of Latin American Operations and he will be speaking at the Miami Conference. “When we publish all the names of the board members, you will be very impressed,” said Vilenchik.

Bringing People Together Across Blockchain Initiatives

When asked whether taking his company public is counter to the “decentralized” doctrine of the blockchain community, Vilenchik explained that it was quite the opposite. “The whole idea of blockchain is a way to keep people honest and to provide transparency. By creating our infrastructure with blockchain, investors will always have control and we will be best able to deliver the product to the market. Filing with the government does not make you a traitor to the ideals of the blockchain community; it just makes you compliant to the real world. Many ICOs are failing because they are trying to create something that can’t be accomplished without proper government licenses.”And Amerenec seems to be a good example of how a blockchain business can integrate effectively with government regulation. Vilenchik believes that the success of the blockchain community depends on education and communication across sectors. And this is why as owner of Crypto World Journal, he has spearheaded the Blockchain Nation Conference. “It’s not just a whole bunch of technology fans singing kombia and promoting their ICOs. These events enable the general public to learn and for industry and government leaders to dialogue. When the blockchain community can understand the concerns of the government and the government can understand the problems that the blockchain community is trying to solve, they can align on how to work together most effectively,” said Vilnechick. And his excitement about the upcoming Conference in Miami was palpable. “The speaker lineup is just amazing. I’m so proud to know all of these people, call them friends, and have all of them be a part of this event.

”Blockchain Nation Miami will take place April 25-26th at the Kovens Conference Center in Miami. Notable speakers include Frank Abagnale, the authority on forgery and document security and inspiration for the movie Catch Me if You Can; Andrew Filipowski, the successful high-tech entrepreneur and CEO of Fluree; Ronnie Moas, Founder and Director of Research at Standpoint Research; Sally Eaves, CTO at MindFit; and Jim Rogers, Chairman of Rogers Holding and Beeland Interests Inc., who Vilenchik describes as “the person who the government goes to when planning financial systems.” For more information about Blockchain Nation Miami, visit http://www.bcnation.com.

Vilenchik has also furthered his mission of “building a better blockchain community” by organizing the past two Coinsbank Blockchain Cruises. The most recent cruise was a 5-day tour from January 15-19, 2018 that sailed 600 blockchain enthusiasts from Singapore to Thailand. Notable speakers during the 2018 cruise included: John McAfee, the anti-virus software pioneer; Kaspar Korjus, the head of Estonia’s e-residency program; and Jorg Molt, an early digital currency backer. “The cruise this year went extremely well. People liked it a lot. The concept of the cruise was to build a family within the industry. People are still communicating on a WhatsApp that we started on the very first cruise. This year’s cruise was well organized and succeeded in bringing more people together than ever. Every year the family gets bigger and bigger. On a boat, it’s easier to build warmth and cohesiveness.”And Vilenchik certainly seems to know how to build cohesiveness.

With 20 years of progressive international and Wall Street management experience in finance, project management, strategic planning, and information technology, he is known for effectively leading and managing the people, resources, and processes required to develop and implement successful business models. As the CEO of Coinsbank, he helped to bring their products to the US market, but overall the problems he solved in that role were very different. Before Coinsbank, Vilenchik owned mortgage real estate and title. He got involved with Coinsbank when friends in technology and mining sought out his guidance for building the “credible banking model” behind Coinsbank. Vilenchik is originally from Belarus, immigrating to the US when he was 16. After several years in the Marine Corp, he started his first business. To learn more about Amerenec, look for Andrew and his team at Blockchain Nation Miami or visit www.amerenec.com.

The digital money revolution

- A code that is resistant to counterfeiting

- The ability to prevent “double-spending” (spending money that is a forgery or counterfeit) with a network that verifies each transaction by adding it to a distributed ledger or blockchain

- A limited supply, and the market’s ability to divide single units into smaller fractions on a nearly infinite basis

- An almost instantaneous and irreversible peer-to-peer transmission of value via the Internet, without the need for a trusted third-party intermediary

- A decentralized network, which provides network security and transaction verification

- Incentives built into the network protocol that encourage participants to contribute computing resources for network support

- A global transaction ledger that provides publicly available knowledge that a transaction has occurred

- Personal data security made possible by public-private key crypotography

- A dedicated core team of developers and miners who continually support and improve the code, help secure the network and validate transactions

A brave new way to exchange valueMany believe that cryptocurriencies represent a new phase of technology-driven markets that have the potential to revolutionize how we exchange value to the benefit of consumers and macroeconomic efficiency. Cryptocurrencies represent the potential for unprecedented access to a global payment system without such factors as having a credit history or a bank account.Bitcoin—the first and most recognized cryptocurrency—was created in 2009 by an entity known as Satoshi Nakamoto is response to the 2008 banking crisis. Bitcoin was designed to address the problem of manipulation of the banking system by bankers and the government. It was designed to give people greater freedom, privacy, and security in their transaction.Bitcoin is fundamentally different than the fiat banking system. The Bitcoin network utilizes many nodes distributed around the world in order to validate transactions on the blockchain. The distributed ledger is maintained by any individual or corporation willing to run nodes and validate transactions. The blockchain is therefore a tamper-proof record of what transactions have occurred. Bitcoin and other cryptocurrencies are transferred by using digital wallet software. These types of software generate a public wallet and the private key that goes with it. The table below addresses some of the specific differences between Bitcoin and the traditional banking system.Advantages of Bitcoin

- Does not require trust of any one entity or corporation to work

- Free from the manipulation that has plagued the traditional banking system

- Easy and inexpensive to send transactions from one part of the world to another

- Bitcoin debt cards provide a link between the traditional banking system

- One easy global currency

- Acceptance gradually increasing

Advantages of Traditional Banking System

- Already an established system

- Bank cards are nearly accepted everywhere

- Ability to charge your money back in the event of fraud

- Use of cash does not require network connectivity or electricity

Disadvantages of Bitcoin

- Not accepted by the majority of merchants

- Blockchain databases can consume a lot of power and are expensive to secure

- Legal issues in some countries, such as Ecuador

- Provides an easy, anonymous way for criminals to make financial transactions

- Irreversible transactions in the case of fraud

- The risk of a 51% attack where one mine gains a majority of the networks power

Disadvantages of Traditional Banking

- Open to manipulation of figures

- Fractional reserve banking makes this a higher risk option

- Inflation slowly can erode value of cash

- Lack of transparency about how the system runs

- Bank fees can be expensive, especially for businesses

- Banks in different countries use different systems and currencies, so global transactions can be slow and complicated

The potential to change businesses and the worldThe use of cryptocurrencies could produce major changes across multiple industries such as government, banking, and retail. Blockchain technology could enhance the privacy, security, and cost-effectiveness of many types of transactions for both businesses and individuals. The broader adoption of cryptocurrencies in developed economies will be strongly tied to the evolving regulatory environment. When consumers gain better understanding of crypto currencies, see reliable exchanges with a higher level of consumer protection, and have access to innovations that aren’t available through traditional payment systems, consumers in developed economies are likely to adopt cryptocurrencies on a broader scale, according to many experts.

Potential impact of cryptocurrencies on various industries

- Ethereum: Ether, as the currency is called, is run on the Ethereum network. It has become popular because of its ability to create and maintain smart contracts. A smart contract is a computer program that defines and maintains a set of conditions. Businesses have started to utilize smart contracts because they offer greater security and protection from losses.

- Ripple: Ripple was created to aid the banking sector facilitate global payments. Ripple has reported that 3 of the top 5 global money transfer companies are expected to use XRP (Ripple’s cryptocurrency) in payments this year, with more on the horizon.

- Bitcoin Cash: Bitcoin Cash is a Bitcoin variant that aims to speed up how quickly transactions are processed. This variant was created in 2017 when there was a disagreement between miners on how to address scaling issues.

- Cardano: Ada, Cardano’s coin, can be used to transfer funds digitally. But its developers say it’s setting itself apart with a platform that balances privacy with regulation to promote financial inclusion.

- Litecoin: Like Bitcoin Cash, Litecoin was created as an off-shoot of Bitcoin. Litecoin’s main differentiation point is a quicker speed of settlement. Litecoin aims to settle transaction in 2.5 minutes versus the 10 minutes for Bitcoin. Litecoin can also be bought and sold on mainstream exchanges like Coinbase, whereas most alt coins must be purchased on other exchanges with Bitcoin or Ethereum.

- NEM: NEM is differentiating itself by focusing on helping enterprises improve logistics and payments with a highly customizable blockchain depending on the elementary or advanced needs of the customer.

- Stellar: Stellar’s currency is called the lumens. Stellar’s founder, Jed McCaleb, is a veteran in the industry, having built and sold Mt.Gox—the first bitcoin exchange. Stellar is focused on the way payment networks transfer money.

- NEO: The aim of NEO is to establish the framework for the “smart economy” with a distributed network by using blockchain technology and digital identity to digitize assets and automate their management using smart contracts.

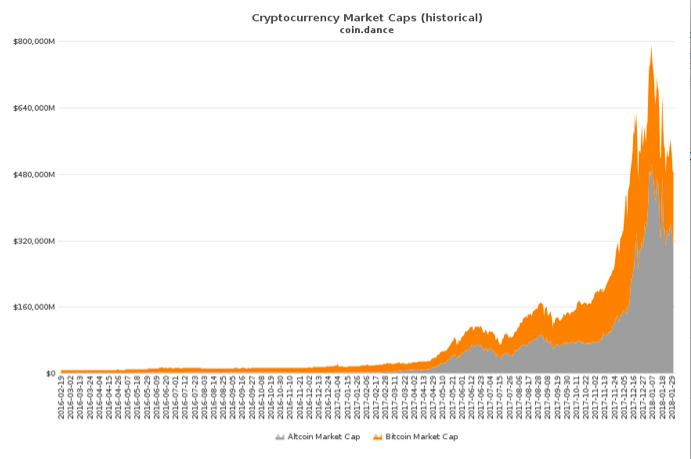

Two other interesting altcoins are Monacoin and Dogecoin. Monacoin is a decentralized, open-source cryptocurrency forked from Litecoin predominately used in Japan based on a cat meme that frequently appeared on the 2chan message board. Monacoin is accepted as payment by many online and physical stores in Japan. Adoption of cryotocurriencies has been easier from a regulatory standpoint because cryptos are considered a legal method of payment.Dogecoin—based on a popular internet meme (the Japanese shiba inu dog) – has also seen substantial growth over the past year. Dogecoin was created in 2013 by Jackson Palmer to help users send and receive money online. Unlike Bitcoin the supply of Dogecoin is plentiful with 100 billion coins outstanding. While the market cap of Dogecoin spiked to nearly $2 billion in early January, it has since retreated to $573 million as of February 1, 2018.2018: The year of cryptocurrenciesThough Bitcoin and other cryptocurrencies have seen some volatility and there are certainly some kinks to work out in how to integrate them into our current system, the consensus is that these digital currencies are here to stay. Many experts believe that the distributed trust enabled by cryptocurrencies have the ability to profoundly affect people in all walks of life. Cryptocurrencies offer improved transparency and accountability of businesses and governments and a more cost-effective transfer of value. The growth of cryptocurrencies in 2017 is just the beginning. While experts expect the volatility of the cryptocurrency to continue, many agree that all the interest in cryptocurrency will yield to a fully developed asset class in the near future.